The Indus Valley Playbook

On the evolution of the Indian startup ecosystem, or Indus Valley, and the distinct set of hacks and business models that have evolved to help Indian startups win — The Indus Valley playbook.

About this essay / TL;DR

This is a long essay; my longest ever at ~7k words. Still, I hope you will indulge me as I set out the evolution of the Indian startup ecosystem, or ‘Indus Valley’, and the emergence of the Indus Valley playbook — a distinct set of hacks and business models that help startups win in the unique Indian market.

The essay has three sections.

1. Origin and evolution of the India startup ecosystem or Indus Valley as I call it.

2. Forcing functions or constraints that influence Indus Valley — these include a relatively small consuming class, emergence of a two-track consumer startup ecosystem, presence of a high-quality English-speaking tech workforce, an undersized + underformalized enterprise space, and an over-indexed venture + startup ecosystem.

3. A look at the playbooks that have evolved in Indus Valley given the forcing functions: these include distinct India1 + India2 approaches in sectors such as Ecommerce, EdTech, Fintech; consumertech startups designed for success in U.S. market a la their B2B SaaS peers; full stack models over marketplaces; SaaSTra or SaaS + Transaction as an approach for Bharat SaaS; reducing reliance on ad-led models etc. I double click on each of these themes or playbooks, to detail out the playbook. Occasionally I speculate on future playbooks.

I have been thinking of writing this essay for a while now. Many of the individual elements of the playbook I share were identified and later shaped in my mind as we developed sectoral theses for investing at Blume. Others came through interactions with founders. And a few as I wrote this piece out. But these are only some of the elements of the playbook. There are lots more, and I invite others to identify and detail out more elements of the playbook. Together we can set out the Indus Valley playbook in full.

Finally, I hope to help readers, both in India as well as those outside India curious about the fast-evolving Indian startup ecosystem, sensemake this space, and gain perspective. If I can help at least one founder or investor learn more, I think the purpose of writing this would be achieved.

Section 1: Evolution of the Indian startup ecosystem

1.1 Origin Story

There is no easy or convenient origin date for India’s now vibrant startup ecosystem. Still, we can look at 1985 as one possible origin point. This is when Kiran Nadkarni, supported by ICICI head honcho Narayanan Vaghul, set up a division within ICICI to ‘invest’[1] in unlisted, early-stage companies. They partnered with seven firms — including three software services firms and a bubble gum manufacturer — in what probably were the first ‘venture’ deals in the Indian startup ecosystem. The division was eventually absorbed by TDICI (Technology Development & Information Company of India, which is now ICICI Venture), India’s first ‘venture’ fund founded in 1988, which Kiran Nadkarni went on to run as the CEO.

Much of the ’90s were a quiet period for venture capital or even the startup ecosystem in India. Software Services was the hero sector of that era — Infosys, Wipro, TCS emerged as star companies during this period (though none of these three were venture-backed). Venture’s two big successes, both in software and coincidentally both backed by TDICI, were Mastek and Kale Consultants. It took the internet boom of the late ’90s, concentrated in the ’99 — early 2000 period, to spark the creation of a tiny venture ecosystem. But it was short-lived, with the sharp crash of ‘00–01 wiping out many startups, and eventually leading to the disappearance of these venture funds. A venture winter set in for the first half of the noughties.

As the decade wore on, the first wave of Indian unicorns (the term wouldn’t be coined until much later) began to emerge. These were companies such as Info Edge (Naukri), Make My Trip, Red Bus etc. Scarred by the ’00–01 crash, and the subsequent challenges of raising capital, they had built strong, capital efficient businesses. Accompanying them were VCs such as SAIF Partners (now Elevation Capital), Helion etc. This was the period when the startup ecosystem as we recognize it now came into being. Many of today’s well-known startup brands and unicorns such as One97 / PayTM, BookMyShow, InMobi were all founded during this time frame.

The rise of Flipkart, in ’09–10 and up until Jio’s launch in the second half of ’16, can be earmarked as the second wave or phase of startup evolution in India. This was the period when ecommerce, food delivery, B2B software product companies all took off. This was also the phase when mega-funding rounds and late-stage growth capital came to India. And with Jio’s launch, the emergence of UPI and the rise of mobile computing, we entered the third wave. The hero sectors here include edtech, fintech, SMB SAAS etc. Many of the winner companies here are mobile-first or even app-only companies like Khatabook and Sharechat.

An interesting theme in Wave 3 is the emergence of the seasoned founder, well-versed with launching and scaling software products; these seasoned founders include second-time founders as well as CXOs (product, engg, biz dev) from hyperscaling, well-funded startups. These seasoned founders found — and continue to find — it easier to source funding, close rounds faster, typically at higher valuations than first-time founders, and scale faster.

Here is a table summarising these waves.

The result of these waves has been a vibrant and sizeable venture and startup ecosystem. If we were to measure the importance or the impact of the startup ecosystem by the amount of venture funding, then India would be the third largest market after USA and China. KPMG Venture Pulse Q3 ’20 put India’s venture market at $3.5b invested, after $15b in China and $37b in USA. Not bad from where we started out.

1.2 ‘Indus Valley’

India’s vibrant startup ecosystem, concentrated in the eastern suburbs of Bangalore, the satellite cities of Gurgaon and Noida in National Capital Region (NCR) surrounding Delhi, the districts of Lower Parel and Andheri East — Powai belt in Mumbai, the Southern suburbs of Chennai, and scattered pockets across many other cities such as Pune, Hyderabad, Chandigarh etc., has lacked a name. I like to use Indus Valley as a catch all moniker for the Indian startup ecosystem. It is a twist on the typical Silicon Wadi / Glen / Fen naming convention, as well as a reference to the Indus Valley Civilisation, one of the vibrant centres of the ancient world, and the ancestral civilisation of the Indian people.

Unlike Silicon Valley, which has a geographical connotation[2], the term Indus Valley has no such overtone. It is instead a reference to the entire Indian startup ecosystem, spread throughout the nation. It is also an attitude, a mindset. Of invention, ‘jugaad’ or ‘dekhi jayegi’[3], and chutzpah.

The challenges of operating in and scaling in a challenging economy like India — with constraints of market size, startup-unfriendly regulations and intense competition, but on the other hand access to opportunities that large numbers of product + tech talent, easy access to diaspora in Silicon Valley, and good English skills, yield — has resulted in the emergence of a distinct startup ecosystem; one with its own hacks, approaches, models and growth strategies. This is the Indus Valley playbook.

Much as how China evolved as a distinct or parallel startup ecosystem with unique codes and rulebooks for success, India, too, is evolving as one. That said, India will never be as distinct as China. It will perhaps be a ‘distinct variant’ given the similarities between our playbook and that of Silicon Valley. The folks at Nexus Venture Partners see India as a combination of China (with its huge domestic market) and Israel (with its strong tech talent and cross-border companies). It is a good way to look at the Indian market, and this dualism in some way inspires our unique approach, our Indus Valley playbook.

This post is an exploration of the playbook or playbooks, a listing of its key elements, how they work and what it implies. And through this exploration, I hope to arrive at, and enable an understanding of the Indian startup ecosystem. But before we head there, let us begin by understanding the distinct constraints of the Indian startup ecosystem, and how they have guided the development of the ecosystem along distinct lines. These are, to me, the forcing functions of the Indus Valley playbook.

Section 2: Forcing functions

The term ‘forcing function’ began as a way to describe behaviour-shaping constraints in product or software design, like how a microwave doesn’t start until its door is closed. I am extending the phrase to describe how an event or constraint can spur or hasten an outcome, e.g., COVID as a forcing function for testing or assessments to go online, or to drive adoption of telehealth, and so on.

I see five broad forcing functions that guide the course of the startup economy in India, and, have in some led the evolution of the Indus Valley ecosystem. These are:

1) A low per capita income economy, with a small but evolved consuming class. India’s per capita income is $~2k putting us at the bottom quartile of nations. But the sheer size of the country means we are also the fifth or sixth largest nation in terms of total economic output generated. We have a small consuming class, that I call India1[4], of about 10% of the population, but 10% of 1.3b people is still large by Western standards: 110–120m people across 25–30m households that earn $~9k per capita on average (this is roughly the per capita income of Mexico, effectively the lower rungs of OECD nations) and account for a $~1tn economy. These 110–120m India1 denizens[5] are comfortable with English, western in attitudes, work in white collar jobs and are plugged into the global economy. This small by India standards but sizeable by western standards consuming class is the engine driving India’s consumption economy. Its size, and expansion, determines in turn the size and growth of India’s digital economy.

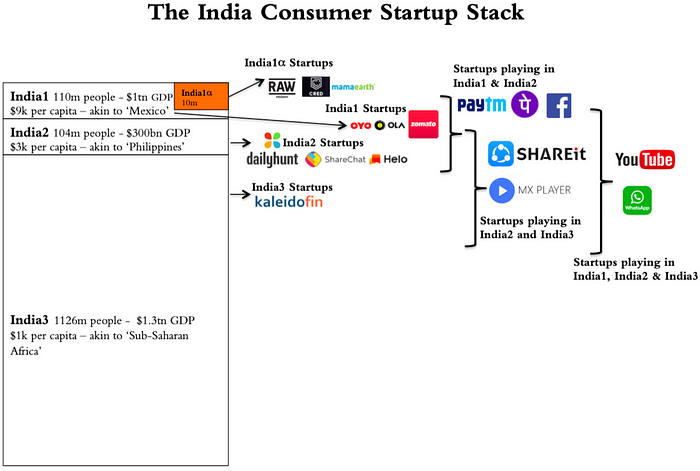

2) A two-track consumer market. Much of the online spending has thus far been driven by these 110–120m (25–30m households) India1 consumers. For a long time, these consumers constituted the limits of the internet in India. But thanks to Jio and cheap bandwidth, we have seen an explosion of less affluent, non-English speaking consumers come aboard the Indian internet. I refer to these consumers as India2. In fact, the India consumer startup ecosystem can be seen in terms of four tiers or stacks. Here is a graphic illustrating the four tiers from a previous essay of mine. It is now 3 years old — some of the numbers would have changed slightly.

India2 customers have distinct needs of their own, e.g., vernacular content, access to blue collar jobs etc., and a host of startups have emerged to address this segment’s needs and problems, e.g., Sharechat, Vahan, Meesho etc. Additionally, few products or startups have universal usecases enabling them to play in India1 + India2/3 (exceptions include payments, content platforms and horizontal ecommerce). The Indian startup ecosystem is thus cleaving into distinct India1 and India2 approaches catering to these segments. We can view it as a two-track market — a relatively affluent westernized India1 market, and the emerging wallet-thin vernacular India2, each calling for distinct business models to meet their needs.

3) A sizeable high quality tech workforce, comfortable in English and who wouldn’t be out of place in Silicon Valley firms. If we use Github accounts as a proxy for the quantity and quality of tech workforce, we find that India has the third largest number of Github accounts by nation. (Though this is impressive, it is also a function of our large population; in per capita terms, we don’t feature in the top 20 countries.) Additionally, going by personal experience, I can share that in the past five-to-seven years there has been a steep increase in the quality of tech & managerial talent that can launch and scale software products. I referred to this earlier as one of the themes of Wave 3 in the evolution of the Indian startup ecosystem.

A key contributing factor to this has been our over-developed (for our income and stage of development) higher education infrastructure, especially in engineering, which produces around 70–80k high quality engineers (~700k engineers graduate but only a tenth are high quality engineers) and perhaps another 20–30k liberal arts + business studies graduates annually.

Allied to the above is our English-language prowess — going by sheer numbers we are in all likelihood the fourth largest English-speaking nation — after USA, England and Canada. There are about 25–30m fluent English speakers in India per my estimate (and another 100m or so who can read and write comfortably enough in English to engage in business transactions, but are not fluent in it). These 25–30m ‘English Fluents’ constitute the most affluent consumer segment in India (See India1 Alpha in orange in the graphic above illustrating The India Consumer Startup Stack). These are our Netflix watchers, our iPhone users, our Starbucks quaffers. They think in English, and their attitudes are markedly western. Their worldview is American e.g., they know more about the U.S. Supreme Court than India’s. I find it useful to think of these ‘English Fluents’ as a virtual nation called EnglIndia (or IndAnglia or AngloIndia) comprising a population of ~30m with a per capita income of $~16k / GDP of half a trillion[6].

4) An undersized and underformalized enterprise space. I recall a recent interview that Manish Sabharwal of Teamlease, a leading blue-collar staffing co, gave sometime in the early days of the COVID lockdown. The notes I made from the talk have him mentioning that there are 63m or so enterprises in India (USA, which is 9x our economy’s size has only half those many). Of these 63m, only 19,500 have paid up capital greater than ₹10crs, he says. The rest are small and medium businesses / mom and pop establishments / sole proprietorships many of whom do not have employee benefit schemes like provident fund or medical insurance etc., in place; for instance, the 6th Indian Economic Census (2013; The 7th one is presently on) found that 95% of India’s 45m or so non-agricultural establishments employed 5 or less workers.

The Indian Staffing Federation estimates that India has around 49m white collar + fixed-term contract staff (this is just under 10% of the overall 493m labour force). These pretty much constitute the limits of the formal economy in India. I am sharing these stats to showcase that while India has a visible and growing enterprise sector, it is still relatively small and underformalized. The relatively small size of the formal economy in India has important implications for startups that want to build large B2B businesses, as we will see soon.

5) An overdeveloped venture + startup ecosystem, relative to the low per capita income and spending capacity[7]. Earlier, just at the end of the past section, I mentioned how India has emerged as the third largest venture ecosystem (by $ deployed). India’s strong presence in the venture league tables is extraordinary when you consider that our per capita income is $~2k and we are one of the poorer countries of the world. What could explain this? Multiple reasons abound but the key factors include

- the diaspora’s strong concentration in the tech sector in the U.S. (largely a result of our overdeveloped higher education infrastructure leading to brain drain). India’s startup ecosystem is much more strongly plugged into Silicon Valley than that of a Japan or a Germany, both far wealthier, and potentially larger consumption markets, making it easier for funding and talent to flow between US and India.

- success demonstrated by the startups funded in Wave 1 / Wave2 — these include both domestic B2C (Flipkart, PayTM etc) and international B2B startups (FreshDesk, Dhruva, Postman etc.) many of whom have US / international investors who have seen markups and see it as proof of performance.

- the ever-standing promise of India as the next China! And now as a counterweight or alternative to China as it gets harder for US investors there.

Now that we have understood the key forcing functions — a relatively small consuming class, emergence of a two-track consumer startup ecosystem, presence of a high-quality English-speaking tech workforce, an undersized underformalized enterprise space, and an over-indexed venture + startup ecosystem, let us look at the implications of these and how these in turn have influenced the evolution of Indian startup business models and playbooks thus far.

In the next section, I look at six different sectors and cover how the forcing functions at play influenced their evolution, and eventually led to the emergence of a unique playbook for startups to compete and win. I will also speculate as to how the future playbooks will likely evolve hereonwards. Let us start with Etailing first.

Section 3: The Indus Valley Playbook

3.1 Etailing

Etailing (or online retail or ecommerce) matters — after all, it is with this sector that the true emergence of India as a key startup hub began. It is etailing that sparked off the entry of Tiger and other international investors (including the late growth stage capital) into India. It is the sector where we first saw megafunding rounds, and after all it is etailing that offered Indian consumers their first glimpse of the startup revolution.

Despite all the buzz and noise, it is instructive to note that etailing in India hasn’t had the true transformative impact that its proponents would have liked. Last calendar year, etailing accounted for $38b in spending. That is a near 40% jump over 2019 CY ($27b); the sharp jump spurred by COVID. Etailing will close at ~5% share of overall retail; last year was 3%. COVID has sparked a 200bps jump (bps = basis points; 100 basis points constitute a percentage). In contrast, China’s etailing sector which closed last year at $1,200bn jumped 600bps by 26 to 32%; US jumped 450bps from 16 to 20.5% on a base of $~600b. Despite their significantly higher base, they have grown faster than India.

Clearly, the small size of the consuming class in India (the 25–30m households in India1), is indicative of the overall scale of online retailing in India. In a previous essay, I have written about how the undersized Indian consuming class inhibits scaling of Indian startups. India1 or people like us are about ~110m in number (or 25–30m households); these account for most of Indian online shoppers (~135m in 2019 per Redseer). India2, the emerging consuming class, is about ~100m or so. They are just entering the consumption market and will hopefully expand the market in the coming years. However, their incomes are generally low, and have likely further been impacted with COVID, and hence we haven’t seen much spending from them.

Here is a chart from Redseer (screenshotted of an online presentation they did on 9 October 2020) where they detail out how the growth of the Indian ecommerce market this year is more due to spending by existing customers (ATV in the chart below stands for average transaction value), and not an expansion of the market.

So how have Indian startups adapted to the low potential for etailing? It is worth noting how inventive Indian startups have been in exploring different online retailing models. Meesho and Shop101 led the social commerce wave, Milkbasket and others the microdelivery wave, then the group buying startups such as Dealshare and Mall91 and now the content commerce players such as Bulbul, SimSim etc. Each of these waves can be seen as an attempt to fashion new interaction models for ecommerce.

Search was the interaction model for India1 ecommerce — you knew what you wanted, you typed it in the search box, and ordered. The model evolved to remove as much friction associated the transaction as possible such as Cash on Delivery to address any payment friction. But it hit a ceiling as it crossed the India1 market into India2. Search-led interaction models were a high friction ecommerce model for India2 consumers. Online shopping warranted a certain comfort with the interface, and certain awareness of the format to transact. Hence, each wave of these ecommerce startups attempted creation of new interaction models that minimize friction as far as possible — Meesho helps you buy from someone you know, Dealshare helps you buy together, Bulbul helps you discover + buy when you didn’t know what to buy. Going forward my guess is that the next ecommerce wave will be led by Josh, Chingari, Roposo as they enable the next wave of content or influencer-led commerce, built atop their streams and short videos.

In parallel to these India2 ecommerce models aimed at getting nontransactors or the new internet users of India2 to buy, we are seeing new models emerge in India1 or India1A commerce as well. Broadly these are built around curating D2C brands (Cred’s new model of burning Cred coins on brands of your choice; LBB is another curation-commerce play) or quirky craft brands often from craftsmen or small batch creators (Etsy wannabes like Zwende, Quirqstation etc.) The mantra here is to create surprise or delight, sparking purchase.

3.2 Edtech

Similar to the distinct India1 and India2 models emerging in Etailing, we are beginning to see the emergence of India1A and India2 models in EdTech too. The last few years of edtech have largely been about the expansion of test prep (for higher ed largely but also for jobs) + K12 tuition. We are beginning to see the market coalesce around Byju’s, Unacademy and Vedantu. The nature of the education market, and its universality mean that edtech players won’t face as much of a challenge in expanding into India2 as their ecommerce brethren did. All of India has to take the same tests to get into elite colleges, or get into government jobs. Given this, edtech companies don’t need to innovate on interaction models like social commerce or content commerce, in order to expand into India2. They can succeed by providing access for India2 to ‘quality’ educational and test prep content.

Access is the key word here. Even if you were in an affluent family in a small town like Satna or Cuddapah, there was no way you could purchase high quality educational content beyond what was available in your city. That meant you had to send your son or daughter to a bigger city or an educational hub like Kota for them to access quality education. EdTech delivers access to quality educational content; in fact these firms can afford to hire the best teacher of that subject and scale them across their entire student base, at affordable prices. The best edtech companies in India thus solve for access, then quality and price.

If ‘access’ is what edtech solves for primarily in India2 (and India1), then ‘identity’ is what it is solving for primarily in India1A. Let me elaborate.

Over the past decade or so, an elite international (IB / IBCSE) + central board school track (CBSE / ICSE) has emerged in India graduating 400k[8] students annually. These are the children of People Like Us — they don’t have the hunger to participate in the intensely competitive entrance exams that their parents sat for. They are softened by a regime of ballet and football and art classes. They are also more well-rounded and well-aware. Historically their lot has gone to college abroad, but now that this category has expanded, we are beginning to see a large number of ‘affluent-enough-to-send-kids-to-these-schools-but-not-affluent-enough-to-send-them-abroad’ parents as well. To cater to these parents, we are seeing the emergence of new age colleges like Ashoka, Krea, Ahmedabad University, a category of colleges I refer to as MERIT colleges in a past essay.

These new age MERIT colleges, along with their western counterparts, do not select candidates just on the basis of a single test, but by also evaluating the candidate as a whole — academics certainly, but also through essays and their profile (including volunteering and extra-cuuriculars). Dev Khare puts it well here.

If the India1/India2 student’s success in getting to the college of their choice comes down to performance on a single test, then the success of India1A student is by building their profile or life as a CV. After all, the college that is selecting you is doing so on the basis of a holistic evaluation of your profile — across academic as well as non-academic parameters. Hence the rise of India1A edtech startups that are enabling new age or differentiated learning — Uable, Mastree, Lido Learning etc. (White Hat Jr certainly began here but expanded into India1 as well when they hit pandemic-market fit). The goal of India1A startups is thus to help you craft an identity[9] that can be recognized by a college of your choice in India or abroad, in much the same way that a India2 startup is about access to quality education to help you prepare for college abroad. The India1A edtech startup is about helping you leverage your existing identity to connect to the global highway, while the India1/2 edtech startup is about helping you ride the Indian highway to prosperity.

3.3 Consumer EdTech + content plays as the new SaaS. India as the 51st state of USA for B2C.

Global success of B2B SaaS startups such InMobi, Zoho, Freshworks, Druva, Icertis, Postman etc., over the past decade has been a key theme in the Indus Valley success story. Leveraging high quality English-speaking tech talent, along with a successful GTM (Go to market) approach to expand from Bangalore to Bay Area, has yielded several success stories. Today no one blinks when you meet a B2B startup founder in India who says s/he wants to build for the world. It is in fact the preferred model in Indian B2B, for India has few buyers to pay for SaaS (more on this in the B2B section).

We are beginning to see the emergence of the ‘Build in India for the World’ model in edtech as well. WhiteHat Jr was earning ~60% of its revenues from U.S., before it was acquired by Byju’s. CueMath, Simplilearn, Eruditus all are making 50%+ of their revenues from USA. Great Learning is not too far behind. All of these started in India catering to the domestic market, and expanded abroad as they saw greater willingness to pay and receptivity in the US market. But we also have Quizizz which is an India company that started off with a US-specific product that has no relevance for India.

The success of these edtech plays, and the similarity that edtech has to SAAS — both purely digital (100% bits, not atoms), high gross-margin plays — leads me to believe that we will begin to see the first wave of global or US-first edtech product / SaaS plays soon. Recently a couple of edtech founders who pitched to me showcased their product as an Indian diaspora / global product. Clearly the wheels have begun spinning.

If edtech can build a global product out of India, what about their content brethren? A speculation follows.

If you include the diaspora of about 8–10m English-speaking Indians to the 25–30m that are fluent English speakers in India, you are talking about a 35–40m affluent populace. With the diaspora we are the 3rd largest English-speaking nation (after US, UK), and sans the 8–10m diaspora, the 4th largest (Canada enters the picture then). If you estimate the number of fluent English speakers globally (including countries such as Nigeria, Pakistan) we would get 400–450m. We are about 8–10% of this. Not insignificant; remember these 8–10% in India constitute the elite of a nation, unlike the English-speaking population of USA, UK, Canada, ANZ than span a wide range of incomes.

We often joke about the many coconut Indians — brown outside / white inside — who share similar value systems as the West and often enjoy their media more than ours. Given this, I wonder at what point would be we see an Indian startup build and launch a global media co / app out of India? What if an Inshorts launched a mainstream Canada or NZ product instead of launching in Hindi? Why can’t a Scroll expand to become a mainstream global news product a la QZ? Why can’t YourStory be a global competitor to TechCrunch[10]?

I do think a key theme in the coming years will be consumer-tech startups using India1A / English-speaking audiences as an onramp to the West (instead of the older strategy of expanding into India2 like how Byju’s and Inshorts have done). EdTech and Content / Media are clearly low-hanging fruit given that they are purely digital, and hence you do not incur high operational costs of manufacturing and distributing in global markets, e.g., MX Player from Times Internet has expanded to US, UK and other international markets targeting the Indian diaspora. Similarly we could see plays in healthcare / wellness emerge, e.g.., diet or nutrition counselling or online 1:1 fitness training / mental health counselling targeting U.S. customers using Indian counselors. One of our portfolio companies, HealthifyMe has done well in South East Asia, especially Malaysia, through this model.

Could this model extend to other spaces in ConsumerTech, like D2C brands? Well, atoms businesses are far harder, and also have inferior unit economics unlike their bits counterparts. That said, we are beginning to see more and more enablers emerge to make D2C launches and scaling easier. Airhouse helps D2C brands ship products to consumers within USA; Flexport helps your export it easily from India; then there is Sourcify and manufactured.net (Blume portfolio co) which helps D2C brands identify manufacturers and source products.

Perhaps the next wave of D2C startups from India, the future Raw Presserys, The Moms Co, The Whole Truth bars, will take advantage of these enablers to test and get to product-market fit in India 1A (the famed Indiranagar Market Fit), and then quickly expand to relevant global markets, again leveraging these enablers. This leads to me a metaphor which I often use internally within Blume, that if Israel was akin to the 51st state of US for B2B products, as the small market of 9m couldn’t absorb the innovative products that their startup ecosystem produced, and the easy links between Israel and US helped them generated a repeatable GTM model of expanding into the US market, then India with its 25–30m affluent English-fluent elite could be akin to the 51st state of US for B2C. It could use the 4m or so Indian diaspora in the US as a beachhead to enter and succeed in the market. Building a B2C playbook won’t be as easy as building the B2B playbook (not that building the B2B playbook was easy), but I do believe that the ingenuity of the Indian startup founder will lead to the first set of experiments emerge in the next 1–2 years.

I must acknowledge here that there have been previous expansions and launches by Indian consumertech companies abroad. Oyo is the canonical example. But there is also Ola and Zomato, though it seems Zomato has downscaled its international presence to focus on India. There is Raw Pressery which launched in Qatar, UAE and Kuwait. Urban Co (previously Urban Clap) expanded into Dubai and Abu Dhabi. And so on. Clearly, international expansion has been a longstanding element in the Indus Valley playbook historically. Given this what is new, you ask? Well, one important point is that international expansion in the past was the preserve of the well-funded startup. It was a response to hyperfunding in an undersized market. To ensure that your growth wheels spinned, you went abroad (or went full stack or moved into adjacencies as I wrote here). The difference is that now we are seeing the emergence of consumer-led startups that are designed or conceived for the U.S. or Western market with key arms stationed in India, unlike before where the U.S. strategy was a reaction to slowing growth in India.

3.4 A weak ad market and what it implies for monetization

Our low per capita income also impacts the ad market. For an attention economy to emerge where eyeballs can be farmed and sold to advertisers, the underlying eyeball has to be of value, i.e., the viewer’s time has to be of some value. In the Indian context beyond the 50–60m affluent adults of India1 and perhaps the top 10–20% adults of India2 (about 5–10m people), there is a sharp drop off in purchasing power. This results in our undersized ad economy, for what is the point of creating desires in people without the means to fulfill those desires?

The Indian ad market in FY20 was $~10b or so (₹72,500crs per KPMG). For comparison, this is smaller than the Australian ad market which was at $12.7b or so in CY19. Remember, the size of Australia’s population is just 2% of India’s population! At $10b, the ad intensity (ad sector size / GDP) of the Indian market is 0.4%. Incidentally, this ad intensity has remained unchanged for as long as I can remember. I joined the media industry in ’02 and since then have been hearing about how the ad intensity would triple to hit 1% (that was the global average). It has barely budged from that.

A key reason for this is the low per capita income. Yup, our per capita incomes have grown[11], but they haven’t grown at the kind of rates that make for a vibrant ad market. This is why India accounts for 13% of so of Facebook’s monthly active users but only ~1.3% or so of revenues[12]. Kunal Shah, founder of Cred, and an astute observer of the startup ecosystem calls India the DAU (Daily Active User) farm of the world for global apps — a place where you can get millions of free eyeballs, but few that will pay.

The correlation between ad intensity or ad attractiveness of a media category, and the affluence of its users is an iron-clad one. I remember reading a wonderful piece in the New Yorker about a Chinese granny who went viral on Kuaishou, a TikTok clone. An excerpt from the piece:

To me what stood out in the above excerpt was the split between YY, which caters to affluent urbanites and monetizes through ads, and Kuaishou, which caters to less-affluent audiences in smaller towns and has to monetize primarily through in-app payments. It is interesting how a 2-tier media market is emerging in China, a market where inequality of incomes is widening.

The Indian online media market will also evolve in a similar direction, I feel. India1 audiences like us will remain attractive to advertisers, and perhaps here an exclusively ad-led model can emerge, or rather has emerged and is being exploited by Google, Facebook, Instagram[13] etc.; India2 audiences less so, and audiences here will be monetized through a combination of programmatic ad sales, in app payments, and perhaps even commerce. Kuaishou, the app referred in the screenshot above, released its IPO prospectus recently. It clocked two-thirds of its revenue from in-app purchases (virtual currency gifts for hosts); much of the remaining came from advertising, and finally a small but growing number from ecommerce. This is the likely model India2 audience-focused apps could likely replicate and evolve into.

3.5 Full stack models and vertical search

There has been a tendency for startups in India to begin as marketplaces but to go full stack (Oyo runs hotels, Urban Co makes beauty products that their contractors use). There are multiple reasons why these startups evolve into full stack models. Typically, Marketplaces have thin margins. But these can be justified if the volumes are large. Then there is the cost of scaling. In the West you can pass on the cost of adding inventory to the buyers and sellers. They can thus scale at minimal marginal costs, and this reflects in Western marketplace startups’ generous unit economics.

In India, the volumes aren’t as large — this derives from the overall low per capita income and market sizes. Secondly, scaling inventory requires a lot more manual intervention — greater monitoring, handholding of customers, onboarding of sellers etc., impacting unit economics. As a result, operating a pureplay marketplace business can mean a thin margin low volumes business; one that is not exactly a venture-friendly model. This is one key reason for the need to go full stack — to expand your margins, and to show larger revenues.

On a related note, there is the rise of vertical search plays. The horizontal search play is of course Google. Now, Google, for all of its two-decade long presence in India still hasn’t crossed $2b in search revenue[14]. Chipping at Google is a bunch of vertical plays — some easy to recognize ones such as MyUpchar, Vokal etc. Then there are vertical transaction plays including service / delivery ones such as UrbanClap, Dunzo, Zomato etc., or even vertical commerce plays. These are all vertical search offerings with the transaction layer bundled in. One way to see these is as the unbundling of search into narrow, structured full stack formats so as to enable easier transactions. Imagine them as narrow Googles designed to solve user and discovery friction.

The monetization model that Zomato, MyUpchar are all pushing is not so much advertising but transactions. Rather than act as an intermediary to another brand, they are saying they will solve for the intent via a full stack model. Why is this so? One reason is that India is a low-trust and high friction market. US is the reverse; there, search and transaction can be unbundled far easily, whereas in India search + fulfilment are best bundled as one.

The above is one reason why increasingly the best businesses in India will seek to control the entire value chain in an industry, instead of only enabling a transaction layer. Yes, there are some layers that can be unbundled and API-ized. Payments and Razorpay is the best example. But increasingly, the better business in Indus Valley, given the forcing functions at work, is a full stack play.

On the topic of search and its relative failure in India, it is interesting to see that search is struggling in China, too, as the interwebs there are splintered across multiples apps and sites, walling themselves off from web crawlers.

The link referenced in the above tweet is this piece.

3.6 SaaSTra

It is worth noting that none of the SaaS unicorns in India have come from serving the domestic market — from Zoho to Freshdesk to Druva to Postman to Zenoti, all of them are global plays. Much of their revenue comes from serving global customers. Is a Bharat SaaS play possible — one where all of your customers are based in India? Well, yes, but the playbook that is emerging for domestic SaaS plays is as a SaaS + Marketplace model, one where you use SaaS software as a hook to fashion a marketplace, and then facilitate transactions and take a cut of it, or sell fintech / loan products. I like to call this model as SaasTra — a portmanteau of Saas + Transactions. It is this thesis that Indian SaaS would grow as SaasTra and not a pure SaaS like in the West, that inspired our bet on Classplus and Procol.

The reason why SaasTra is emerging as the playbook for domestic SaaS is because of the low levels of formalization and capitalization in the Indian economy. There aren’t that many large well-capitalized Indian enterprises (remember we saw in the Forcing Functions section that there are only 19k or so enterprises with capital above ₹10crs). The remaining don’t have the kind of profit pools or funds to pay to sustain venture scale on-cloud SaaS product plays. If there aren’t that many enterprises in your space that will pay, for your venture to hit $5m ARR (typically where a Series B of $10–12m can be raised), there are two choices — expand abroad and become a pure play SaaS co, or become a SaasTra play, where you either make the product free to scale fast (Khatabook) or give it at an affordable price (Classplus) — both help you scale customers fast, who then onboard their customers. You can then help them sell more to their customers and try to get a fee of the transaction. Or perhaps help sell loans, and so on[15].

3.7 Other playbooks: There are of course more playbooks, at play and in development in the Indian startup ecosystem. I will pause here though with my exploration of playbooks. For one, my goal was not to exhaustively list every playbook. It was to give you a sense of how distinct Indus Valley playbooks have emerged, in response to the forcing functions and constraints at play as well as to give you a glimpse of potential playbooks such as global edtech products. Two, some of these playbooks such as India B2B / SaaS playbook for expanding abroad is reasonably well-understood. Third, this post is now nearing 7,000 words and is entering that uncomfortable space between a monograph and an essay:) It is time for us to bring this to a stop. But before we close, let us take a quick run through the playbooks thus far.

We are seeing distinct India1 and India2 playbooks emerge in sectors such as etailing and edtech. I am certain there are similar playbooks for Fintech and Healthcare too. In FinTech, for instance, Smallcase is clearly India1, Avail Finance is India2 and Kaleidofin is India3. Moving beyond the domestic market, we are beginning to see consumer startups especially in edtech take steps in international markets too. The first wave of consumertech startups built in India, for the US, are not too far away. Meanwhile, B2B / SaaS startups are doing the reverse, turning their eyes from US and the West, their natural territory, to the Indian market. The traditional SaaS playbook here morphs into a SaaSTra playbook. Startups competing for the India market know that they have to go full stack, and try and own as much of the transaction funnel as possible — they have to evolve multiple approaches to monetization as ad or subscriptions alone may not be enough, given low purchasing power. Phew!

Section 4: Conclusion.

The Indian startup ecosystem or The Indus Valley ecosystem is now in its fourth decade. Despite the constraints it operates in, the several forcing functions that guide it, it is now the third largest startup hub by inflows. The unicorns and success stories emerging from India point to the distinctive set of strategies and tactics that Indian startup have adopted, keeping in mind the constraints (low purchasing power, low levels of formalization etc.), and also leveraging the advantages (strong tech talent, English skills, a decently sized affluent elite segment) to survive and flourish. We catalogued a few of these distinct strategies, approaches and hacks, and from these explorations can see the emergence of a distinct Indus Valley playbook.

I will end this long post now, making two final points. One, this post or at least the key themes in it have been in my mind over the past year or so, as I tried to understand the Indian startup ecosystem and its evolution. Writing this out over these past few days is an attempt to explore these in my mind, and to think aloud. And that brings me to point two. The best form of thinking aloud is a debate and for that I would love to get your thoughts. What are the elements that you think I missed out on? And what are the elements I overstressed? How will this playbook evolve in the coming years? What new elements will get added? What will get weeded out? How would your Indus Valley playbook look?

I am immensely thankful to Manish Singh (TechCrunch’s India hand; he is @refrsc on twitter) for his deep reading of the piece and the editing suggestions; acknowledgements also to Vedica Kant and Karthik Reddy for reading the draft. Feel free to reach out for any clarifications or feedback at my email id (sp@blume.vc). I would love to hear from you.

[1] ICICI here refers to ICICI Ltd, and not ICICI Bank. ICICI Ltd was founded in 1955; it promoted and launched ICICI Bank in ’94, akin to how HDFC promoted HDFC Bank. ICICI and ICICI Bank merged in 2002. These seven investments were made before the emergence of any regulation or legislation that defined venture capital. That happened in ’88. The ‘investment’ was structured as a combination of equity + ‘conditional loan’. ICICI typically invested ₹30 lacs (3 million rupees) in the firm, one-third of which was used to buy equity at par (for anywhere from 20–40% of the firm!), while the rest was a conditional loan — this carried no interest; the holder instead received royalty of 2–10% on sales. No data on tenor or buyback terms. Source: “Creating an environment: Developing venture capital in India (2001)” by Rafiq Dossani & Martin Kenney.

[2] Due to the COVID-led migration of many of Silicon Valley’s thought leaders to Austin, Miami, Los Angeles (worth noting this was happening well before COVID too), it has become common to refer to Silicon Valley in terms of a mindset, and not a geographic location. This tweet by Patrick McKenzie (@patio11) describing how many think he lives in Silicon Valley when he is in Japan, and the reactions to the tweet, is a good representation of this thought.

[3] ‘Jugaad’ is a Hindi word meaning hack or frugal innovation. See Wikipedia entry for Jugaad. ‘Dekhi Jayegi’ is a Hindi phrase which literally means ‘we will see’ but really means something akin to ‘bring it on’. It is used in the spirit of ‘Let us do it without waiting for permission. We will apologize later.’

[4] See essay India2, English Tax, and Building for the Next Billion for details on India1 and how I arrived at these numbers.

[5] One important factor to keep in mind is that these elite Indians are geographically dispersed across the country. Unlike in Italy where there is a concentration of affluent population in Northern Italy leading to desires for separation, in India the broadly even dispersion has meant that there is no Indian region that has a markedly different economic profile from the other.

[6]While I don’t have the exact per capita income for this group, it would’nt be far off the mark to estimate 2x the income levels of India1 for this subgroup (India1 was $~8k, so take these as $~16k). My confidence for this 2x estimate comes from the Goldman Sachs income estimate of India’s top 2 segments (they call it Movers & Shakers and Govt Elite though a better term would have been White Collar Elite) — see page 27 of “India Internet: A closer look into the future: July2020”

[7] I have written about how overindexed we are on venture (or over-ventured) as a nation in the essay India2, English Tax and Building for the Next Billion.

[8] Calculation: IB + IGCSE has ~200k students enrolled. Then there are the central boards. We have another 1.3m or so in ICSE and ~20m in CBSE. We will take about 20% of the CBSE students as ‘India1A’. This means 5.5m enrolled. About a tenth to a twelvth of these graduate every year. Let us take the conservative twelvth. That means about just over 450k elite students graduate. Let us assume 400k.

[9] An alternative term I wrestled with was ‘passport’ in the same sense that they help you create a globally-recognised passport of your skills and abilities.

[10] Not just startups, but there is also scope for India to become a hub for great English entertainment content, for the same reasons I shared above. We are beginning to see early signs of this, led by OTT content financed by Netflix, Amazon Prime etc. They are financing storytelling appealing to the sensibilities of India1A / India1 largely such as Sacred Games, Delhi Crime, Made In Heaven, Paatal Lok etc. Most of these switch between English and Hindi, with different emphases. Some like Paatal Lok are 90% Hindi, 10% English. Made in Heaven is the reverse. In the coming years, we are likely to see the 1st Indian English global hit emerge, telling a uniquely Indian but globally appealing story. It will start by relating to the 45–50m India + Diaspora English speakers but will tip over to Non-Indian English speakers as well. Related thoughts on this topic in this piece of mine.

[11] India’s per capita income was $~300 in 1991 when our liberalization began. In 2019, we were at $~2.1k (World Bank). China was $~330 or so in 1991 — they are at $~10.3k in 2019. We have grown at a CAGR (Compounded Annual Growth Rate) of 7.2%. China at 13.1%. Sigh.

[12] No well-validated public sources. I am using 328m MAUs for FB in India and 2.45bn MAUs globally to arrive at ~13%. For revenue we know Facebook hit $~70b in rev globally in CY19. India numbers aren’t easy to come by. I am using $900m for 2019 from this piece. Let me know if you have anything better.

[13] Incidentally Flipkart and Amazon are emerging as decent sized players too. I heard about a year back from a source, that Flipkart on a run rate of $200m (₹1,500crs). I am not certain of this. It could well be overestimated.

[14] It is hard to figure out what exactly they make — not all of the India-specific search ad revenues are booked in the entity for which they declare their numbers (source). See here for a glimpse of what is happening.

[15] Here is an interview / podcast where Nikhil Kapur of STRIVE (also fellow investors in Classplus) makes much the same point. The relevant passage is at 17:30 mins.