Narrative Capital

A fan reached out to me after a recent tweet of mine (below), asking for a ’smol essay’ on what I meant by the term ‘narrative capital’ and what it means for the future of funding. Here goes.

First, the tweet

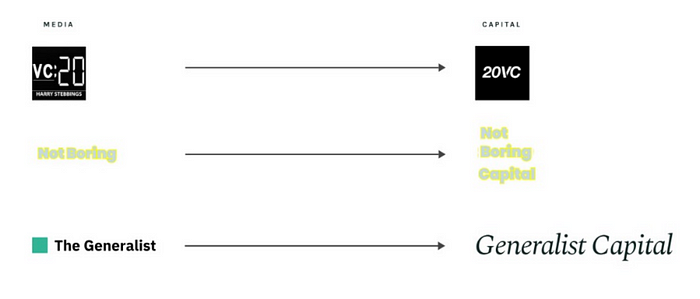

Narrative Capital is my term for a trend that has accelerated lately in venture capital; one where writers / podcasters / media creators purveying tech and startup content have raised funds / vehicles to invest in startups. Effectively, they are leveraging their large and growing fanbase of followers and consumers to launch an investment vehicle. These funds aren’t very large (typically in the $10–20m range) with the exception of Harry Stebbings (20VC) who did raise $140m.

What explains / underpins the rise of Narrative Capital, and what implications does it hold for venture capital’s future? Let us take these in sequence.

Understanding the rise of Narrative Capital

It is important to understand Narrative Capital’s rise as the confluence of a few trends, all relatively well-known though.

First, venture capital and tech’s success saw more and more money being allocated by large institutions (university endowments, charitable trusts, family offices etc., or the Limited Partners) to venture fund managers (General Managers). Increased supply of capital has meant both a rise in the number of funds as well as the rising size of funds, as they try to accommodate the excess capital. For the funds that are rising in size, there arises a unique first-world problem, that of deploying capital while maintaining past or better investment alpha.

Secondly, the venture investing playbook and the rules for success here is well understood and internalised across the technosphere (across founders / operators / observers and creators), such as the power law, paying up for high quality companies (than paying cheap for lower quality assets), getting access to seasoned / repeat founders etc.

The last point provides us a natural segue into an important but less known and less understood trend. This, and also our third point, is about the emergence of the repeat or second / third time founder, fluent with the ways of scaling and thus a less risky bet than a first-time founder.

And these three points thereby beg the question — if so much of the venture playbook is internalised across the technosphere, and if so much investment alpha rests on getting access to high-quality repeat / threpeat founders, then why not industrialise the access?

This is precisely what is indeed happening with the rise of such strains of early stage investing vehicles such as Founder or Operator-led Capital (e.g., Sahil Lavingia’s rolling fund), Narrative Capital, Scout Programmes etc., all of whom I bunch into a category called Access Capital (Narrative Capital is only one strain of these). These are essentially microVC funds that are effectively productising access to early stage founders.

Narrative Capitalists in particular have an unfair access advantage as a result of their distribution power. Their media properties act as bat signals attracting founders of all strains to their doors. Even if founders don’t reach out, Narrative Capitalists are likely to hear earlier about early stage investments given their networking and connects, and can also reach out to founders and get into these deals.

It makes sense thus for VCs to partner (fund) with Narrative Capitalists or for that matter the other strains of these MicroVCs / vehicles who are enabling early access to founders. Not surprisingly, a lot of the capital into these vehicles are actually coming from mainstream venture funds (and founders). Their capital needs are too small for traditional Limited Partners to consider them. Instead they are solving a deployment and access challenge for mainstream venture funds. Investing in these Access Capital enables mainstream funds to track interesting founders, and come into the successful ones without any signalling risk.

Implications for Venture Capital

Broadly this is a trend that most mainstream venture funds have welcome and spurred even.

For one, discovery of new founders has gotten harder as we have lots of new founders starting out. There isn’t as much time as before to research a space and talk to founders. Outbound, which never was a viable strategy in itself earlier, is even more underwhelming today given the jump in the number of founders. A VC fund needs a strong inbound strategy and this explains the rise of bat signals from venture funds — blogs, podcasts, newsletters by funds and VC investors.

The rise of remote dealmaking spurred by COVID means that fundraising friction has come down dramatically for founders. So the investment process is now fast (though post the meltdown it has eased up somewhat). It is very difficult for an investor to move very fast when they don’t have knowledge of the space or don’t know the founders well. This is where having one of your Access Capital partners as an investor helps as you can ref-check the space and founders through them (also very likely they would have spurred the initial intro themselves).

For founders too, the rise of Access Capital, and specifically Narrative Capital is a much welcome trend. The dealmaking is faster, there isn’t an ownership mandate per se (often Narrative Capital plays at the growth stage too for hot companies), and these fund managers are helpful too, especially in using their audience base to drive distribution. Here is an example of how a Packy McCormick story cut his portfolio co ScienceIO’s CAC by half.

TLDR

Narrative Capital is one of the strains of what I like to term as Access capital, the others being Operator Capital, Scout Programmes etc. These arise because as the forces underpinning the evolution of venture capital — deployment pressure, emergence of widespread understanding of the proxies of a good founder, ability to get early access to repeat founders — make it easy for modularising venture capital into key lego blocks. The first lego block that is being carved out is Picking / Sourcing / Finding / Access (I have used these interchangeably here though within the VC community we would not use them interchangeably).

Related Readings

The Future of Solo Capitalists — Mario Gabriele

Lessons from 140+ Angel Investments — Lenny Rachitsky